Understanding Bonds: A Basic Overview

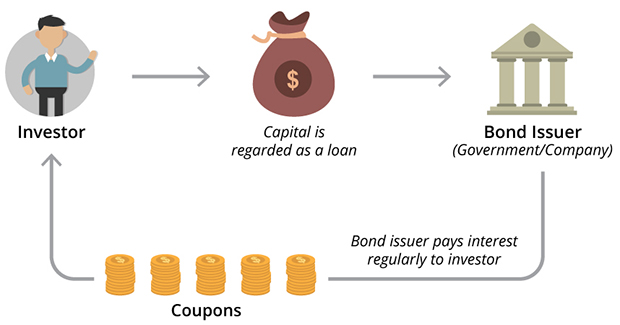

Bonds are essentially debt securities issued by governments, corporations, or other entities to raise capital. When you invest in a bond, you’re lending money to the issuer in exchange for periodic interest payments and the return of your principal at maturity.

Key Features of Bonds:

- Face Value: The amount the bond will be worth at maturity.

- Coupon Rate: The interest rate paid by the issuer to the bondholder.

- Maturity Date: The date on which the bond matures and the principal is repaid.

- Credit Rating: A measure of the issuer’s creditworthiness, which affects the bond’s yield.

Why Invest in Bonds?

Bonds offer several advantages as part of a diversified investment portfolio:

- Regular Income: Bond investors receive periodic interest payments, providing a steady income stream.

- Lower Volatility: Compared to stocks, bonds tend to be less volatile, making them a suitable option for risk-averse investors.

- Diversification: Adding bonds to a portfolio can help reduce overall risk by offsetting the volatility of stocks.

- Inflation Hedge: Government bonds, particularly Treasury bonds, can be a good hedge against inflation, especially during periods of rising prices.

- Capital Preservation: Bonds are a reliable way to preserve capital, as they offer a fixed return and a guaranteed principal repayment at maturity.

Types of Bonds

There are various types of bonds, each with its own characteristics and risk-return profile:

- Government Bonds: Issued by governments, these bonds are generally considered low-risk due to the backing of the government’s taxing authority.

- Treasury Bonds: Long-term government bonds issued by the U.S. Treasury.

- Municipal Bonds: Issued by state and local governments, often offering tax advantages.

- Corporate Bonds: Issued by corporations to finance their operations or specific projects.

- Investment-Grade Bonds: Issued by financially stable companies with a strong credit rating.

- High-Yield Bonds (Junk Bonds): Issued by companies with lower credit ratings, offering higher yields but also higher risk.

How to Invest in Bonds

There are several ways to invest in bonds:

- Direct Bond Purchasing: You can buy individual bonds directly through a brokerage account. This approach offers flexibility but requires more research and management.

- Bond Mutual Funds: These funds pool money from multiple investors to buy a diversified portfolio of bonds. They offer professional management and diversification benefits.

- Bond Exchange-Traded Funds (ETFs): Bond ETFs trade on stock exchanges, providing liquidity and transparency. They offer a low-cost way to invest in a diversified portfolio of bonds.

Risks Associated with Bond Investing

While bonds offer several advantages, it’s important to be aware of the risks:

- Interest Rate Risk: If interest rates rise, the value of existing bonds may decline.

- Credit Risk: The risk that the issuer may default on its debt obligations.

- Inflation Risk: High inflation can erode the purchasing power of fixed-income investments.

- Market Risk: Bond prices can fluctuate due to market factors, such as economic conditions and investor sentiment.

Conclusion

Bonds can be a valuable component of a well-diversified investment portfolio. By understanding the different types of bonds, their risk-return characteristics, and the various investment strategies available, investors can make informed decisions to achieve their financial goals. However, it’s crucial to conduct thorough research or consult with a financial advisor to assess your individual needs and risk tolerance before investing in bonds.