Investing Simplified

Introduction

Investing can seem daunting, especially for beginners. However, it’s a powerful tool to build wealth and secure your financial future. This guide aims to demystify the world of investing and provide you with the knowledge and confidence to start your investment journey.

Understanding the Basics

What is Investing?

Investing is the process of allocating money to assets with the expectation of generating a return over time. These assets can include stocks, bonds, real estate, and mutual funds.

Why Invest?

- Beat Inflation: Investing allows your money to grow faster than inflation, preserving its purchasing power.

- Long-Term Wealth Building: Consistent investing can lead to significant wealth accumulation over time.

- Financial Security: A well-diversified investment portfolio can provide a safety net for retirement, emergencies, and other financial goals.

Key Investment Concepts

Risk and Return:

- Risk: The potential for loss in an investment.

- Return: The profit or loss generated from an investment.

Diversification:

- Spreading investments across various asset classes to reduce risk.

Asset Allocation:

- Determining the proportion of your portfolio allocated to different asset classes.

Dollar-Cost Averaging (DCA):

- Investing a fixed amount regularly, regardless of market conditions.

Types of Investments

Stocks:

- Ownership shares in a company.

- Potential for high returns but also high risk.

Bonds:

- Debt securities issued by governments or corporations.

- Generally considered less risky than stocks but offer lower returns.

Mutual Funds:

- Pooled investments managed by professional fund managers.

- Offer diversification and professional management.

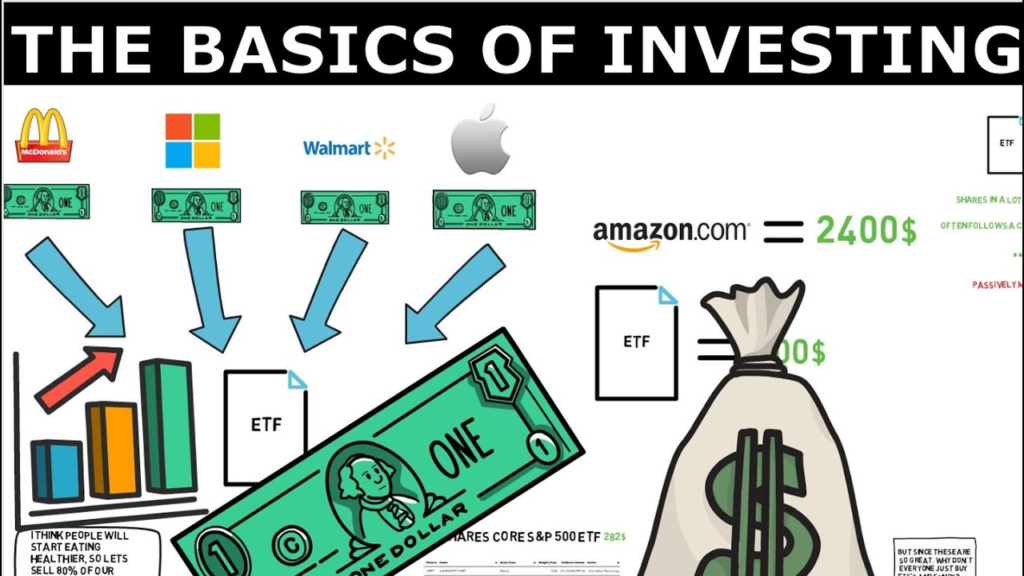

Exchange-Traded Funds (ETFs):

- Similar to mutual funds but trade on stock exchanges.

- Offer diversification and lower fees.

Real Estate:

- Investing in physical property.

- Can generate rental income and potential appreciation.

Building Your Investment Strategy

- Set Clear Financial Goals:

- Identify short-term, medium-term, and long-term goals.

- Assess Your Risk Tolerance:

- Determine your comfort level with risk to choose suitable investments.

- Create a Diversified Portfolio:

- Spread investments across different asset classes to mitigate risk.

- Start Small and Invest Regularly:

- Begin with a small amount and gradually increase your investments.

- Seek Professional Advice:

- Consult with a financial advisor to get personalized guidance.

Common Investment Mistakes to Avoid

- Timing the Market: Trying to predict market highs and lows can be futile.

- Emotional Investing: Making impulsive decisions based on fear or greed.

- Overtrading: Excessive trading can lead to higher transaction costs and lower returns.

- Ignoring Fees: High fees can erode investment returns over time.

Conclusion

Investing is a journey, not a destination. By understanding the basics, developing a sound strategy, and staying disciplined, you can achieve your financial goals. Remember, consistent investing, even in small amounts, can lead to significant wealth accumulation over time. Start your investment journey today and secure your financial future.