Introduction

Investing is a journey, not a destination. To navigate this journey successfully, it’s essential to have a well-crafted investment strategy and a disciplined approach to portfolio management. This article will delve into the key principles of portfolio management, offering practical tips and strategies to help you achieve your financial goals.

Understanding Your Financial Goals

Before diving into the world of investments, it’s crucial to define your financial objectives. Are you saving for retirement, buying a home, or funding your children’s education? Your goals will dictate your investment horizon, risk tolerance, and asset allocation.

Building a Diversified Portfolio

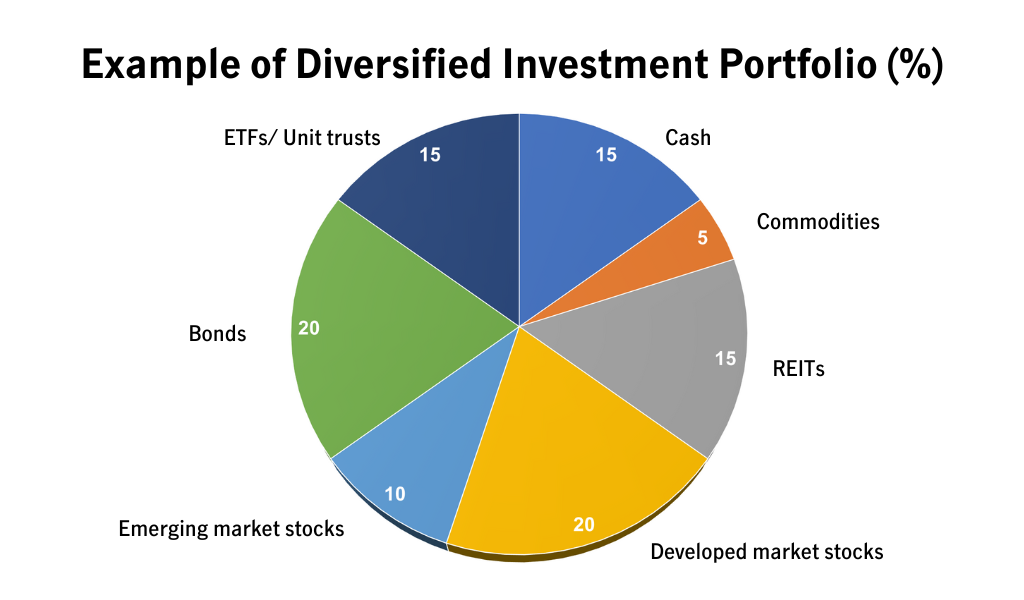

Diversification is a fundamental principle of investing. By spreading your investments across various asset classes, you can reduce risk and enhance your portfolio’s overall performance. Consider the following asset classes:

- Equities: Stocks represent ownership in companies. They offer the potential for high returns but also come with higher risk.

- Fixed-Income: Bonds are debt securities issued by governments or corporations. They generally offer lower returns but are less volatile than stocks.

- Cash and Cash Equivalents: This includes savings accounts, money market funds, and short-term bonds. They offer low returns but provide liquidity and stability.

- Real Estate: Real estate investments can provide income through rental properties or capital appreciation.

- Alternative Investments: This category includes hedge funds, private equity, and commodities. These investments can offer higher returns but often involve greater complexity and risk.

Asset Allocation: Balancing Risk and Reward

Asset allocation involves determining the proportion of your portfolio to be invested in each asset class. A well-balanced portfolio can help you achieve your financial goals while managing risk. Consider these factors when allocating assets:

- Risk Tolerance: Your ability to withstand market fluctuations.

- Time Horizon: The length of time you plan to invest.

- Market Conditions: Current economic and market trends.

Regular Portfolio Rebalancing

Over time, the balance of your portfolio may shift due to market fluctuations or changes in your investment strategy. Rebalancing involves adjusting your portfolio to restore the original asset allocation. This helps maintain your desired risk profile and ensures that you’re not overly exposed to any particular asset class.

Monitoring and Adjusting Your Portfolio

Regularly monitoring your portfolio is crucial to ensure it’s performing as expected. Keep an eye on market trends, economic indicators, and the performance of your investments. If necessary, make adjustments to your portfolio to adapt to changing circumstances.

Seeking Professional Advice

While it’s possible to manage your investments independently, seeking professional advice from a qualified financial advisor can be beneficial. An advisor can provide personalized guidance, help you develop a comprehensive financial plan, and assist with complex investment decisions.

Conclusion

Mastering your investment portfolio requires a combination of knowledge, discipline, and patience. By understanding your financial goals, diversifying your investments, and regularly monitoring your portfolio, you can increase your chances of achieving long-term financial success. Remember, investing is a marathon, not a sprint. Stay focused, stay disciplined, and enjoy the journey. Sources and related content